4 Things to Know About Charlotte Industrial

The years-long pause in industrial property development in metro Charlotte has been good to market fundamentals, PPR real estate economist Noam Kleinman tells us. But the pause isnt going to last forever--just for the time being. (Which is good to know because we almost got a tattoo that said "This Pause Will Last Forever.")

1) Supply Still Constrained

More industrial space in the market was demolished than added from 2009 to 2011, Noam says, resulting in 1.4M SF of negative supply over that period. In 2012, only a few small expansions came on line. Landlords have regained some pricing power as a result, seeing a 4.7% rent increase last year, following four years of decline. New supply isnt expected to outpace demand in the near term, but eventually--assuming the economy continues its recovery-- supply will make a recovery as well. (And then maybe, just maybe, supply and demand will agree for once.) Still, Charlottes expected to have strong positive rent growth thanks to vacancies that are already in pre-recession territory.

2) Demand Has Recovered

Charlottes warehouse market had a solid recovery over the past two years, Noam notes, with a few strong quarters of absorption in 2011 and 2012, fueled by a variety of tenants but with one purpose: distribution. (America was founded on this principal: people need stuff.) Because metro Charlotte is an important hub for regional distribution, demand is spurred both by regional factors (goods moving throughout the Southeast)--which has been the driving force of absorption over the last two years--as well as local economy and homebuilding. The recovery so far has favored newer assets in the 100k SF to 250k SF range, as tenants can now get this newer space at a good price. Conditions for the smaller, older assets will improve as residential construction improves.

3) Investor Interest in Charlotte High

Charlottes emergence as a regional distribution hub has institutional investors diving into the market for choice assets, Noam says. Investment transaction volume returned to pre-boom levels in 2011, besting 2006 totals. Two-thirds of the deals were driven by consolidation in the industrial market, which brought large portfolio transactions that included properties nationwide. This years transactions will feature a mixed bag of small deals, single-asset large deals, and multi-property portfolio sales. (A CREsmrgsbordwithout the heartburn.)

4) Manufacturing Demand Revived

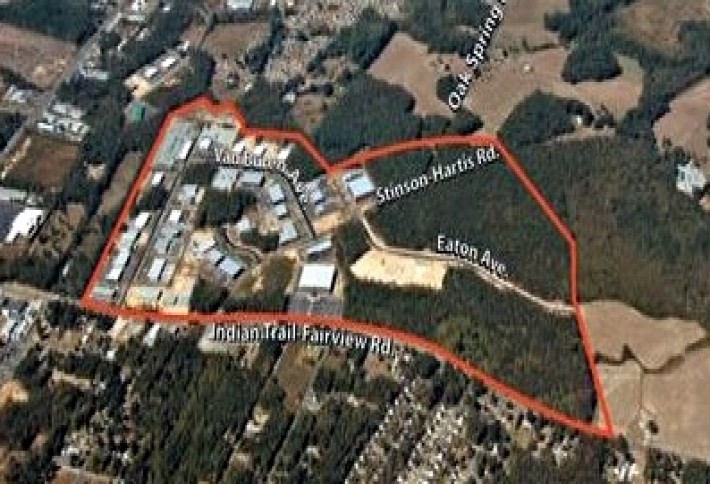

As the manufacturing sector improves, so does demand for that kind of industrial space in metro Charlotte. One recent example: Industrial Alloys Inc bought just over seven acres in Old Hickory Business Park in Union County, and plans to build 40k SF of space there, having outgrown its present location elsewhere in the park. The company is a distributor and processor of carbon steel, stainless steel, aluminum, and nickel alloy products. Merrifield Patrick Vermillions Ken Chapman repped the developer and owner of the park, an affiliate of MPV.