CRE-Backed Loans Surged in Q3

Commercial real estate balance sheet loans climbed to $1.42T in the third quarter, up $77.4B from the comparable year-ago period. That figure puts current BS lending, in which the lender keeps the loan on its books instead of selling it to a bank or investor, 9% above its pre-crash 2007 $1.3T peak, according to a report released this week by Chandan Economics.

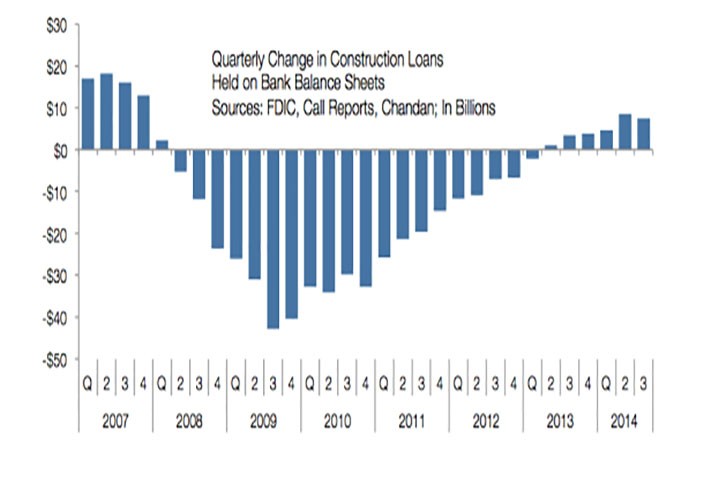

The same report showed that construction spiked to $230.6M in Q3, up $24.6 year-to-year. Still, construction financing is a dismal 60% off its apex before the Great Recession despite six straight quarters of improvement. In cheerier news, Globe Street pointed out that the default rate of 1.3% on multifamily and commercial loans was the lowest since the Lehman Brothers collapse. But bear in mind that that number hit lows of 0.4% before the financial crisis.