|

|

|

|

|

| October 8, 2014 |

Why Investors Shouldn't

Overlook San Antonio

As the fourth-best market in the state, San Antonio has traditionally been overlooked by institutional investors looking at the bigger Texas markets. (Has the city tried Match.com?) But one NYC-based player just refi'ed a retail center and is selling a mixed-use office/retail project here. So when will the rest of the investment world take notice?

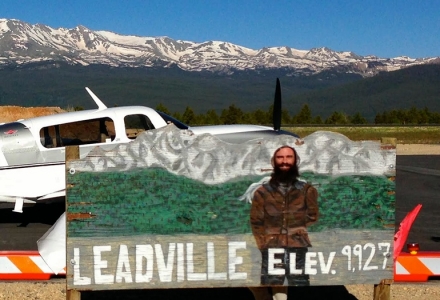

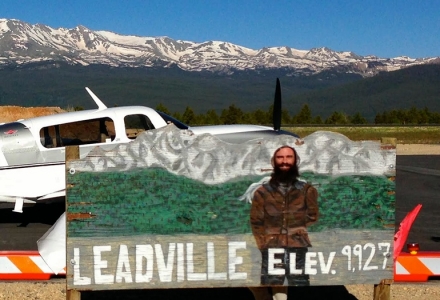

Angelic Real Estate prez Gabriel Silverstein (here with a striper off of Block Island) says if San Antonio were in any other state, it would be on the investment radar for new projects. It's among the top 10 markets for job growth, but it's overshadowed by the combination of Dallas, Houston, and Austin, Gabriel tells us. Outside of USAA, there's few, if any, institutional investors in the market, he says (being locally headquartered, it's hard not to notice the growth when it's outside your window). However, Gabriel thinks that will change over the next two to three years.  San Antonio may not have the dynamic technology and energy industry presences that Dallas and Houston have, but at least for now, it has higher cap rates, and those higher going-in yields will have to attract institutional eyes at some point—especially as vacancy rates tighten and rents move upward, Gabriel tells us. It's not only a large city, it's one of the 10 fastest growing cities (by population) in the US. (San Antonio is all about the Top 10s. Maybe David Letterman should get on board.) Even if the economic base isn't as dynamic, more people means more housing, more consumer needs, and more service industry jobs to provide all those things that we all need—each equaling more real estate. Office vacancies overall are still high in San Antonio, but retail and industrial vacancy rates are falling, and rents are starting to rise.  Gabriel says the office/medical mixed-use project for sale is in the $10M range, so while it won't grab the attention from the larger institutional investor pool, it should generate a lot of local interest. Angelic also just refinanced the 76k SF Los Indios Shopping Center at 905 Pleasanton Rd for a Brooklyn-based borrower, who bought the center in 2007. The new five-year term loan has a 25-year amortization and limited recourse to the borrower. Gabriel led the financing, along with Louis D'Lando of Angelic's Boca Raton office. Gabriel uses one of his hobbies on the job: He's a pilot for the company plane. That's him at the Leadville, Colo., airport with the firm's Mooney airplane behind him. Leadville has the highest altitude airport in North America—recently remeasured at 9,934 feet above mean sea level (even though the sign says 9,927).

|

|

|

|  |

CyrusOne Grows

San Antonio and Austin Footprints

CyrusOne has been on a major expansion spree in Texas, investing $300M here since 2013. (In fact, it's the only public data center company HQ'd here and is now the largest operator in the state with more than 1M SF in a dozen locations.) CEO Gary Wojtaszek tells us it's completing the exterior shell of its second San Antonio facility this month. That'll provide nearly 570k SF of infrastructure, Class-A office, and raised white floor space. CyrusOne was the first enterprise data center provider in the San Antonio market in 2012.

CyrusOne also recently expanded its Austin II data center, adding 5,000 SF of raised white floor space in data hall two. That 65k SF colocation facility (pictured above) is the first of a potential four-phase, 290k SF Austin campus. As you can see, the firm isn't slowing down—Gary says it has land and site capacity to grow to 2M SF in Texas. And it's upping its relationship with Texas as a whole, launching a new research initiative in partnership with universities across the state and committing to a five-year partnership with the Texas Rangers baseball team.

|

|

|

|  |

|

|

|

San Antonio's Impactful Woman!

Congrats to Presidio Title's Kim Ghez, who won the CREW Network Impact Award for career advancement for women. We snapped her receiving the honor at the org's national convention in Miami last week with CREW Network CEO Gail Ayers. Kim has been a driving force at CREW San Antonio for 10 years—last year, she served as president and led the chapter to a 41% membership increase. We don't have space to enumerate all the programs she's spearheaded to bring women in CRE together and mentor the next generation of leaders, but she is co-founder of the UTSA/CCIM Real Estate Competition, which has mentored 275 students to date. |

|  |

How Cedar Park Attracted This New Hotel

|

There's no shortage of reasons why hotel developer Worth Hotels selected Cedar Park for it's next location. Its tremendous population growth (400% in the last decade) and city leaders' willingness to welcome new development continues to lure projects like the new 86-room SpringHill Suites by Marriott, says Dowdle Real Estate prez Lynn Dowdle (with Priority Power Management's CJ Butler on dove opener). She repped Worth Hotels in its location in the Costco-anchored mixed-use project at Hwy 183 and FM 1431. |

|

Mixed-use is attractive to developers, as hotels do well in areas surrounded by retail and restaurants, Lynn says—largely because guests don't have to really leave the property. It also doesn't hurt that the site is at the juncture of two major thoroughfares, she adds. More pluses: The site is in the nation's fourth fastest-growing city in the US (Census Bureau) and less than 20 minutes from downtown Austin, she tells us. The Bundy, Young, Sims and Potter-deisgned hotel, at 1110 Discovery Blvd, is under construction and will open Q1 '16. |

|  |

|

|

|

Don't Miss Our Austin Multifamily Summit

Bisnow is thrilled to announce our fourth annual Austin Multifamily Summit coming up on Oct. 30, where you can hear the experts from ARA, Amli, JLL, Berkadia, HFF, and more discuss the hottest trends driving our market. Are you wondering which developments are in the pipeline or what opportunities are left? Join us as we delve into the depths of multifamily mania, starting with great networking at 7am at the Hyatt Regency Austin. Save your spot by registering now! |

|

|

|

24 Days Until the Top Under 40 Developers / Investors

Meet in Miami

The top developers and investors under the age of 40 descend on the Ritz Carlton in South Beach for Bisnow's first annual "Ascent" multi-day summit. See who's attending and apply to be considered for one of the few remaining spots here. |

One of the few good things about the 90-degree temps is kayaking on Lady Bird Lake without fear of tipping over and freezing off our backsides. How do you take advantage of the warmer weather? tonie@bisnow.com and catie@bisnow.com |

|

|

| |

This newsletter is a journalistic news source which accepts no payment for featured interviews. It is supported by conventional advertisers clearly identified in the right hand column. You have been selected to receive it either through prior contact or professional association. If you have received it in error, please accept our apologies and unsubscribe at bottom of the newsletter. © 2013, Bisnow LLC, 1817 M St., NW, Washington, DC 20036. All rights reserved.

|

|

|