|

You expect crowdfunding efforts for tech, but the guys at Inner 10 Capital had an idea to take advantage of the growing demand for residential product by crowdfunding to raise $25M for single-family projects. (You can now use crowdfunding to invest in a building or help your nephew raise money to go on tour with his calypso-punk band.)  The timing and product couldn't be better. Austin-area home prices hit an all-time high in April rising 6% year-over-year and the average time for homes on the market is 45 days, down from 50 days last year, according to the MLS. Inner 10 Capital managing partner Bryan Hancock (here with his daughter, Avery) tells us there's been a gentrification around downtown, which had been blighted. But, as those neighborhoods are cleaned up and the lots redeveloped into high-end housing, there's a big demand, Bryan tells us.  The private equity firm is identifying urban development projects in Austin's top 10 zip codes to develop more than 20 new homes this year. That's what the $25M is for. The PE fund already has 43 single-family projects in and around downtown Austin through JVs. But, Bryan tells us Inner 10 wanted to broaden the pool of capital available. Crowdfunding became an attractive option once the Jobs Act loosened the securities laws and made it easier to solicit for funders (as long as you reasonably verify the investor's credit). This opens up a new realm of investors, he says. He anticipates these investments to last about four years.  Bryan tells us one project was put on the market last week and sold in two days at the full asking price and that's typical for these deals, he says. (It took us quadruple that amount of time to give away a couch for free.) Most of the homes they've developed generate multiple offers and are on the market less than five days. Every time we think we're running into supply constraints, things seem to pop up, he says. The huge UT sports fan enjoyed the heck out of UT's run in the College World Series, he tells us. He's been going to football and baseball games with his dad for as long as he can remember. |

|

|

BOMA: There's an App for That, Too |

||

That's all Texas Medical Association's Lisa Hensley and Transwestern's Karisa Johnson, both from Austin, have been hearing as they walked the expo floor, where Bisnow has been on the scene this week in Orlando for BOMA's 2014 Every Building Conference & Expo as BOMA's national media partner, producing the convention's official daily newsletters. "Everything and everyone's going mobile, and it wasn't that way just two years ago," Karisa tells us. Even Transwestern has its own app for maintenance, work orders, and communications, she says. |

These lovely ladies traveled from deep in the heart of Texas—Westdale Real Estate's Christie Streicher and BOMA Fort Worth's Michelle Lynn. Michelle tells us her town is buzzing with a new plaza, which has added lots of new retail and office. Meanwhile, Christie (who manages properties in San Antonio and Houston) says she went two years without any construction, so it's very nice to see cranes and tenants expanding. |

|

|

Three Things Student Housing Owners Should Know In the heart of Texas with UT (among the nation's top 10 biggest universities) and UTSA and Texas State just down the road, student housing plays a big role in the hot multifamily market, says FourPoint Student Housing Investments principal Chris Epp (with director of private client services Meredith Wolff and principal Chris Bancroft). The trio (who previously led the student family division for multifamily powerhouse, ARA Real Estate Investment Services) just launched the firm and tells us there are three areas multifamily owners and developers should watch for: amenities, proximity to campus, and investment opps.  No one is building cheap projects, Chris Epp tells us. As the new units deliver (about 140,000 beds nationally for fall '14 and about the same for fall '15), it's an amenities race. Chris Bancroft says it goes back to the early 2000s when dedicated student housing spun off of traditional multifamily. (Like how Baby Gap spun out of the Gap.) Every year developers would add more new amenities and that's continued. Location, too, has been playing a large role in new projects.  There may be some unique value-add buying opportunities on the horizon in the student housing market as the 10-year conduit and CMBS debt comes due in the next two to four years. Most of that product is a little further away from campus and about 10 to 15 years old. These ownership entities—many of which are held in a TIC structure—may be looking to sell or be forced to sell because of maturing debt positions in the deals, Chris Epp tells us. The guys say they already have 10 listings and are working on getting another dozen or so projects to sell. Chris Bancroft tells us he's reading The Frackers and is headed to Rhode Island with his family for Independence Day. Chris Epp is headed to Maine with his family at the end of July. |

|

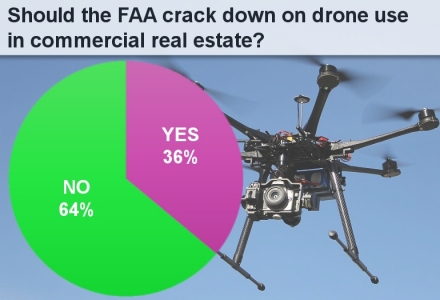

YOU SAID IT: Drones Dandy, But Regulation A Must It would be premature for the FAA to crack down on drone use in commercial real estate, but that doesn't mean they shouldn't regulate it, according to our recent national reader poll. (If the sky is filled with drones how will any of us get a tan?) Almost 700 readers responded, and 64% said the FAA should not put the kibosh on the remote-controlled aircraft in CRE. Drones could be invaluable marketing and asset management tools across the industry, saving brokers a whole lot of time and money on gas (no more spending your whole day touring far-flung sites), readers say. But they aren't without risks. They mention Big Brother-esque privacy concerns, potential collisions with commercial planes, the risk of terrorism (a la this season of 24), and lack of certification and registration for operators.  DC-based Transwestern EVP, government services group, Pete Marcin (snapped in Nashville) has two drones (one's a backup) that enable him to get property views unachievable only a year or two ago. Clients can have live tours with first person view goggles, and it's useful to check out upper floor or roof conditions (better than a cherry picker), he says. While the FAA has taken the position that drone use for commercial purposes is restricted, a recent NTSB court decision calls these restrictions into question, says Pete (oh yeah, he's also an attorney). The future lies in whether the FAA can develop (and Congress can pass) more concrete rules for commercial drone use. If all goes well, Pete expects them to be widespread in a couple years (you can already pilot via iPad app), but would remind operators you'll probably crash your first before you become a savvy pilot. (His first is at the bottom of the Patapsco River.)  Over in Plano, Texas, Milkes Realty Valuation's Joe Milkes (snapped with his wife Shelley and latest grandson Drake) recently saw a drone demonstration that showed the gadget's promise. (Especially if you're appraising a Texas ranch bigger than a county.) One really cool trick: If the building's still in planning stages, developers' can work with digital artists to create a movie adding it into the real-time landscape. Safety and privacy are key, he says, so you don't have frat boys flying a drone a little too close to the sorority house window (no more ladder like in Animal House). Commercial real estate's best bet is to be proactive and help guide regulation, just like it would with planning or zoning issues, he says. Joe and his wife just adopted a six-month-old “bagel,” a Basset Hound/Beagle mix. |

|

|

Just Released: Bisnow Research Report on How Deals Are Getting DoneBisnow is thrilled to be partnering with Chief Executive Research to bring you a 140-page, in-depth report on deal structures. Based on a careful survey of 407 recent deals, our world-class analysts have summarized and evaluated current capital stacks—the sources, proportions, rates, and terms for different types of debt and equity. This is invaluable if you are doing a deal in today's market. Click here to purchase a copy of this report. For inquiries regarding group rates please contact Will at will@bisnow.com. |

|