|

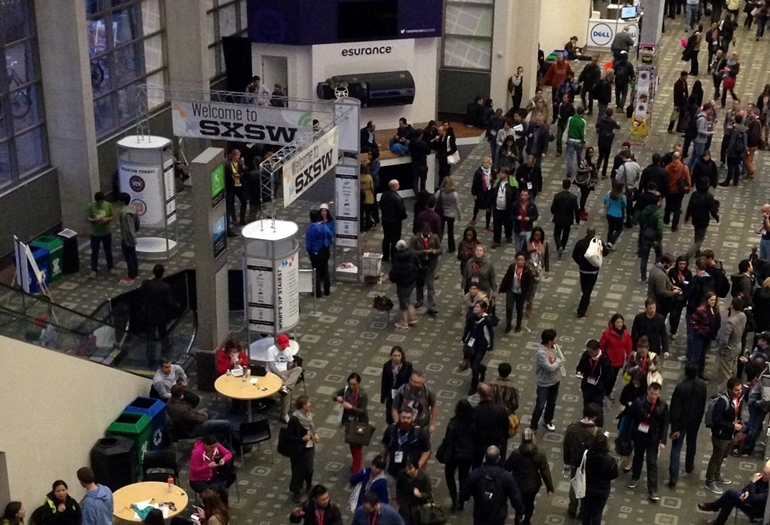

Brant Smith of Berkadia Commercial Mortgage is a speaker and sponsor of our multifamily summit on March 20 (register today). It's a leading provider of capital and a highly rated primary, master and special commercial mortgage servicer. Click here. The traffic caused by SXSW put serious strain on our Lenten decision to give up cursing. But it was also a reminder that Austin's gaining steam as a major tech hub. And not just once a year. We caught up with JLL'ers from around the country: VP Cara Trani, research manager Amber Schiada, VP Blake Searles, VP Greg Matter, SVP Paul Formichelli, and VP Joanne Bestall. They tell us Austin is an established tech market, but it's gaining on San Fran, Silicon Valley, and New York as they become cost prohibitive, especially for startups. (We already beat them in food; now we're gaining in bytes.) Greg tells us there's also less competition for talent here. The Capitol City racked up $255M in high-tech venture capital funding last year.  Tech deals keep rolling in, like Athena Health leasing 115k SF and Under Armour (it's not finalized, but it's taking over 35k SF Downtown for MapMyFitness, which it acquired recently). Overall last year, Austin's occupancy increased 1.6%, while rents skyrocketed almost 10% to $29.72/SF. Northwest Austin, where Apple has a large presence, posted 2.5% occupancy improvement and 6.1% rent growth. The other larger tech submarket—the Southwest—has one of the highest occupancy rates in town at 90.2% and 12.7% rent growth last year.  The team's takeaways from SXSW:

|

|

|

SXSWi Lures Techies from Coast to Coast Here's even more techies from DC, San Francisco, and Maryland at SXSW Interactive (the technology interactive portion of SXSW). Entrepreneurs and business leaders took over the city, schmoozing with emerging tech company leaders as well as larger players showcasing their technologies, says DC-based Cooley biz development head Katherine Ferguson (right, with San Francisco-based YouEye CEO Kyle Henderson). Katherine says SXSWi sparks ideas and is a forum for learning. Here's the Brivo Labs delegation from Maryland (tough gig to come to Austin in chilly March), showing off its security management solutions. The firm just rolled out its first market offering OKDoor, an application that uses Google Glass to open doors. The wearer is inside the building and gets an alert that someone wants to gain access. An outdoor camera sends a photo of the person to the Google Glass, who can remotely unlock the door. We assume they got the idea from Star Trek's Geordi La Forge. |

|

Where'd the Multifamily Deals Go? |

||

There's an abundance of buyers for multifamily. It's available product that's coming up short, says ARA principal Andrew Shih. Why? Some owners are enjoying the cash flow, while others are buyers, too, he says. The cap rates are still low and aggressive. |

Andrew, along with ARA principal Pat Jones, repped the seller (a JV of Falcon Southwest and Center Square Investment Management) in the sale of a 300-unit value-add property in San Marcos. The 95% occupied property was sold to a private owner/operator. The new owners plan to improve the interiors and push the rents, he says. (Just no pushing into the pool.) Andrew and the family are hitting the road today and heading for some cabins in West Texas for the remainder of spring break. Are we there yet? |

|

|

New Bisnow Education Video!By popular demand, we've just released a second video we did with Peter Linneman, widely considered the top professor of commercial real estate in the US. This new video is called "Real Estate Finance," i.e., on how you get money to do deals. Although an advanced topic, it's purposely very simple to understand. It's 77 minutes, broken into 5-minute increments, so you can watch or listen as you are waiting in line, or at the gym, or lying in bed. (To each his own.) Click here for the new video and here for the old video. |

|