|

|

|

|

|

| September 26, 2014 |

What Prompted Hamilton Zanze to Sell Big

Investors everywhere want a piece of Phoenix's sizzling multifamily market, which has prompted Tony Zanze to put over 1,000 Tuscon apartment units on the market. He'll be joining us Tuesday for our first-ever Phoenix Multifamily and Condo Revolution event at the Omni Montelucia Scottsdale to tell us how they're taking advantage of all this capital.

Investors are willing to spend big for apartments here, the Hamiton Zanze co-founder tells us. "Right now, it's definitely a seller's market," he says. Which is perfect for Tony's business plan; he says his firm's goal is always a three- to five-year hold period, which these apartments fall into. (Colliers' Cindy Cooke, whom we spoke with last week, will broker the deals.)

But that doesn't mean Hamilton Zanze isn't opening its own wallet. Tony says it's under contract to pick up Los Arboles (with NY Life) in Chandler for an undisclosed sum. And it looks to acquire $250M in properties this year, mainly in Nevada, Arizona, and SoCal. Even with today's pricing, if you can pick up an apartment around a 6% cap and sell at 5.5% cap, you're still making money, he says. Join Tony and other top experts at our Phoenix Multifamily and Condo Revolution event this Tuesday, Sept. 30 starting at 7:30am. Great networking too! Sign up here. |

|

|

|  |

Lincoln Waiting For Anchor

|

As Lincoln Property Co fills its first planned office building at Waypoint with American Traffic Solutions, we asked Lincoln's David Krumwiede (here with his daughter in a recent tour of the Cubs spring training facility) whether this means part two will be spec. “We would like to get an anchor tenant,” David tells us. “Activity is strong, I will tell you that. We have several proposals out for full-building and partial building users." |

|

The deets so far: ATS inked a deal for 108k SF at Building One, in a planned 20-acre Mesa campus that borders Tempe and Scottsdale in the Southeast Valley. The second 150k SF building will take off, as David indicated, upon another anchor signing. In many ways, it's because Phoenix's office market of late has been shouldered on build-to-suit activity. Think Garmin, GM Innovation Center, and GoDaddy. And that's even with vacancies hovering around 20%. The reason? David says a lot of empty space is tied to smaller suites—a legacy from the Lehman Bros collapse and credit crunch when corporate America went through a drastic downsizing. Big blocks of space are pretty non-existent. |

|  |

Don't Use the Word 'Obsolete' in This Portfolio

What's BH Properties' Steve Jaffe's favorite Shasta flavor? Grape. But he especially loves empty Shastas—warehouses, that is. He's fresh from his firm's purchase of 301 S 29th St in Phoenix, a 63k SF warehouse that was formerly used by Shasta for $1.9M, all cash. What's notable about the purchase: While other investors and developers are focused on big boxes with 30'-plus ceilings, BH went the opposite way, snapping up a product that could be viewed as obsolete for tenants. But “we don't use the word obsolete in our portfolio,” Steve says. Historically, it hasn't had a problem leasing property with reduced ceiling heights. "It's not something everybody needs. And we offer it at a cheaper rate.”

BH doesn't just invest in industrial; it invests in value-add and distressed properties it believes it can turn around. Most recently, as we reported here, BH purchased Ross Plaza, a 65k SF neighborhood center for $3M. But Steve says finding value-add is difficult today, especially in multifamily, where capital is pushing prices up and caps down. “The properties are still value-add, but the pricing is not,” he says. “We're not only seeing this in Phoenix, but we're seeing this in a lot of places where we're back to buying pro forma.” And that means BH is considering selling some of its multifamily holdings in Phoenix. It's too early to say what, Steve says, but the firm does own a dozen properties in Arizona.

|

|

|

|  |

|

|

|

Don't Miss Our Multifamily & Condo Revolution Event!

The hot multifamily sector hasn't even peaked yet in Phoenix. So you won't want to miss our first annual The Multifamily & Condo Revolution event Sept. 30, 7:30am, at the Omni Montelucia Scottsdale. PB Bell's Chapin Bell (pictured), Lennar Multifamily Investors' Scott Johnson, Alliance Residential's Ian Swiergol, and Hamilton Zanze's Tony Zanze will be among the industry experts breaking down current trends, including job growth, capital markets, investment activity, and the effect of new sustainability requirements and innovation on development. Great networking, too! Get your tickets here. |

|  |

|

|

|

Capital Stack Report!

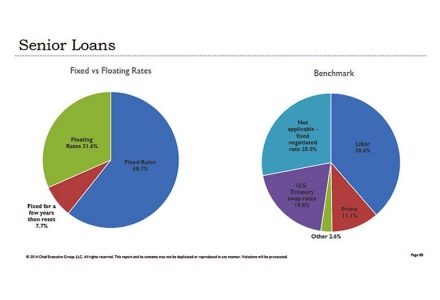

When it comes to senior lending terms, prepare yourself for a surprisingly wide gap in points and fees. This according to the Capital Stack Report conducted by Bisnow and Chief Executive Group. For Libor-based loans, the study finds that there is a 135 basis point difference between the 25th and the 75th percentile, and a 325 basis point difference between the 10th percentile and the 90th percentile. While half of the buyers studied pay over 1% in bank fees, 49.4% pay less than 1% in fees, and 15.4% pay under 0.5% in fees. As well, 49% of borrowers are required to provide a personal guarantee, while the majority (51%) do not. As far as termination fees, 39% pay but 61% do not. What does that mean for you? Let the borrower beware. Be an informed bank customer so that you can assure yourself the most competitive bids. To purchase your copy of this game-changing industry study that will help you master your financing, click here. |

We'll be in your town next week. Try not to flood us out. Send your news to Jarred@Bisnow. |

|

|

| |

This newsletter is a journalistic news source which accepts no payment for featured interviews. It is supported by conventional advertisers clearly identified in the right hand column. You have been selected to receive it either through prior contact or professional association. If you have received it in error, please accept our apologies and unsubscribe at bottom of the newsletter. © 2013, Bisnow LLC, 1817 M St., NW, Washington, DC 20036. All rights reserved.

|

|

|