|

Piedmont Office Realty Trust may scoot out of Phoenix's office market in the future, just as the public REIT expands its Southwest presence.  Atlanta-based Piedmont's Joe Pangburn, recently tapped by the REIT to head up Southwest operations and acquisitions from Dallas, tells us its holdings here include the 150k SF Chandler Forum off South Price Road, the 133k SF River Corporate Center (anchored by US Foods) off South River Parkway in Tempe, and Desert Canyon 300, the 149k SF office building home to Grand Canyon Education off West Peoria Avenue. Its Southwest focus is now Dallas and other hot Texas cities. (You gotta go where the action is.) That's not to say the REIT wouldn't do something in the Phoenix area, Joe says; it's more an allocation thing than anything else.  So that means Piedmont is more than likely to harvest its Phoenix metro assets (like Desert Canyon 300 pictured here) instead of beefing up a presence here, Joe says. While he says Phoenix is in many ways like Dallas and Houston—with tremendous run-ups in employment growth—“it can get overbuilt" because it's pretty easy to build here. |

|

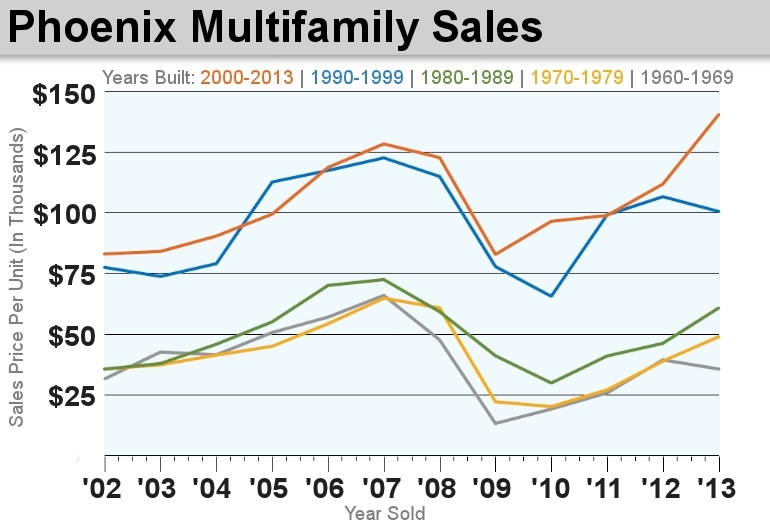

Will Mid-Rise Multifamily Dominate? When Steve Jobs introduced the iPod, people didn't know they needed one (and you know how that story goes). Same for mid-rise multifamily buildings in the greater Phoenix area, according to Transwestern VP Jack Hannum (we'll get to his Megadeth posters in just a few). Historically, buildings were garden-style with the classic, stucco look, he says, but more urban, mid-rise projects make up 43% of 14,000 units coming online over the next few years. In 18 months, we'll see just how successful they are, he says, but we're already seeing some command rents upwards of $1.75/SF.  Source: Transwestern Developers are aiming for a new renter—one who wants a lifestyle and amenities. “It's almost that Phoenix wants to be its own LA,” Jack says. (With fewer paparazzi.) We're seeing more luxurious clubhouses, granite and quartz kitchens, and game rooms that go beyond billiards. And growing around these projects, like Alliance Residential's Broadstone Camelback, is a thriving restaurant and retail scene. “Go to Old Town Scottsdale on a Thursday and it's buzzing,” he says. “There's a bigger city feel than Phoenix 15 years ago.” Strong investor interest is following—even aggressive for the best-located assets.  Now back to the Megadeth posters. When Jack's not specializing in multifamily investment sales, you might just find him at a heavy metal or rock concert. He snapped this pic of his son, Ethan, at the 9-year-old's first concert two years ago. They were in the front for Dream Theater, and behind him is John Petrucci playing guitar. “Ethan was the only kid up front, and the band gave him all the love at the show,” he says. Jack's also down for a good book and is gearing up to re-read a favorite, John Maxwell's Everyone Communicates, Few Connect. |

|

Build-To-Suit Demand Despite Spec Availability |

||

|

While leasing activity is up, CBRE's Pat Feeney is seeing real surge in industrial build-to-suit activity. (Burger King has brainwashed us all into believing we can "have it our way.") And that's despite some eight spec warehouses built since 2012. “Right now, if you're a 300k SF user, you have about eight alternatives,” Pat says. (The most recent build-to-suit was Dick's Sporting Goods.) But Pat says with the recent addition to Apple's 1.4M SF manufacturing facility and State Farm's announcement of a 2M SF corporate campus, there are other companies saying, "Maybe we need to be there." |

Pat is fresh from his 90k SF deal with an electrical part distributor from San Carlos at 4707 E Baseline Rd (above), brokering the deal on behalf of landlord Dalfen America with colleagues Dan Calihan, Rusty Kennedy, Mike Parker, and Evan Koplan. (Mike and Evan also repped the tenant along with CBRE's Pete Wentis and Kevin Cosca.) Pat, Dan and Rusty also recently helped sell the 400k SF, vacant distribution center at 1635 S 43rd Ave for more than $21M. Cohen Asset Management picked up the spec warehouse as part of a 1031 exchange. |

|

|

|

|

Have You Met

|

|