|

|

|

|

|

| September 24, 2014 |

Steady Growth for Commercial Real Estate Lending

We prodded and coerced, trying to get Regents Bank president Steve Sefton to reveal an extreme plan for lending, now that the economy is driving demand for new commercial space. The best we could get out of him? "Controlled ascension." That's probably why he's still in business.

Steve (here with wife Lori in Italy) expects about 10% real estate lending volume growth for his bank this year. He's uncomfortable growing much faster for fear of a bubble. The (eventual) prospect of higher interest rates is driving some of that activity, but mostly it's steady growth in the local economy. Although that makes some people pessimistic, Steve says his clients' sales, profits, hiring, and investment are doing well, pushing the demand for new space.

Overall locally, Steve says, bank lending is up for commercial real estate, and companies are borrowing in higher amounts. You can thank increased construction, and San Diego has a lot of that on the horizon, both downtown and beyond. Recently Regents originated a $2M SBA 504 loan for purchase and upgrades to an owner-occupied San Diego-area industrial building, the kind of bread-and-butter lending that's been steadily rising. Also, life companies are changing their lending patterns, Steve says; not so long ago, they wouldn't consider anything less than $10M. |

|

|

|  |

Bario Logan Becomes a Destination

|

You may have already heard of Bario Logan, an up-and-coming experiential retail market. (If not, we promise not to tell anyone about your unexperiential shopping habits.) Cushman & Wakefield's Aaron Hill singles out one part of the market in particular, Mercado del Barrio, just under the Coronado Bay Bridge. The construction of San Diego Community College next door to the site (look for it in 2015), is driving the area's growth, he says: "The community college's parking garage will be on the opposite side of the Mercado project, so all of the students will literally be traversing Mercado Del Barrio and its retail businesses on a daily basis.The additional traffic will be transformative." |

|

The area is already becoming more experiential, with architects, marketing agencies, and law firms locating near a Mexican roast coffee house, a barrio winery, new restaurants, and a tattoo/barber shop. Shea Properties' Mercado del Barrio consists of a 36k SF Northgate Market, which anchors the center, along with 12k SF of space at the corner of Main and Cesar Chavez. Another building on the corner of National and Cesar Chavez will accommodate 35k SF of street-level retail with 92 affordable apartments. Vista-based brewery Iron Fist Brewing Company is coming to Mercado Del Barrio in early 2015; Aaron repped Shea in the deal. |

|  |

North Park Has What Developers Want

One-and-a-half acres at 2030 El Cajon Blvd has traded hands in North Park, the first large redevelopment project in North Park this cycle, Colliers International's Victor Krebs tells us. (Victor and colleague Gunder Greager brokered the deal between seller AmProp North Park LLC and buyer TR Hale LLC.) It will be catalytic for the redevelopment of this part of El Cajon Blvd, he predicts. The redevelopment of the area is being driven, in part, by young renters attracted by its mix of building styles, its retail, and entertainment—and they're willing to pay top-dollar.

Here's a pic from the Bisnow blimp. The buyer plans to develop a mixed-use project on the site, which is entitled for 180 residential units. North Park is seeing significant interest from developers looking for high-quality infill sites, especially entitled sites of this scale, Victor says. He has also handled other deals in the area, including the sale of the 225-unit La Boheme to DR Horton, the sale of the 89-unit Egyptian Condominiums to CityMark Development, and the sale of the Lafayette Hotel.

|

|

|

|  |

|

|

|

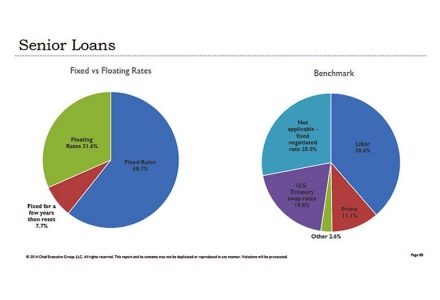

Capital Stack Report!

When it comes to senior lending terms, prepare yourself for a surprisingly wide gap in points and fees. This according to the Capital Stack Report conducted by Bisnow and Chief Executive Group. For Libor-based loans, the study finds that there is a 135 basis point difference between the 25th and the 75th percentile, and a 325 basis point difference between the 10th percentile and the 90th percentile. While half of the buyers studied pay over 1% in bank fees, 49.4% pay less than 1% in fees, and 15.4% pay under 0.5% in fees. As well, 49% of borrowers are required to provide a personal guarantee, while the majority (51%) do not. As far as termination fees, 39% pay but 61% do not. What does that mean for you? Let the borrower beware. Be an informed bank customer so that you can assure yourself the most competitive bids. To purchase your copy of this game-changing industry study that will help you master your financing, click here. |

|  |

|

|

|

Don't Miss Our

Hospitality Summit!

When someone visits San Diego, spends some cash, then leaves, it actually has a huge effect on our local real estate market. Find out how big at Bisnow's San Diego Hospitality Summit: The Impact of Tourism on the CRE Market on Oct. 9 at the Hyatt Regency La Jolla. Our top-notch speakers include Zephyr Partners' Chris Beucler, Allen Matkins' Valentine Hoy, Partner Engineering and Science's Mark Lambson, the San Diego Tourism Authority's Joe Terzi, Lowe Enterprises' Matt Walker, and Portman Holdings' Roger Zampell. Great networking too! Don't miss out... sign up for our event here. |

|

|

|

| |

This newsletter is a journalistic news source which accepts no payment for featured interviews. It is supported by conventional advertisers clearly identified in the right hand column. You have been selected to receive it either through prior contact or professional association. If you have received it in error, please accept our apologies and unsubscribe at bottom of the newsletter. © 2013, Bisnow LLC, 1817 M St., NW, Washington, DC 20036. All rights reserved.

|

|

|