|

Miami's hot, but that doesn't mean city and business leaders can't do more to attract new businesses and make the city a more desirable place for top talent to relocate (and in January and February, everyone thinks about it). That was one of the main takeaways from our Miami State of the Market this week. In the plus column, according to our panelists: enviable weather, but also the city's vigorous and international cultural, culinary, and entertainment growth in the last few decades. Also—at least compared with places like New York or San Francisco—the cost of living here is still fairly low. These are factors attracting businesses and human talent to Miami. In the minus column, however, residential properties between luxury and older stock can be hard to find, the schools need improvement, and transit isn't all it could be. About 220 attendees joined us at the Intercontinental Miami.  Snapped: Flagler VP-investment sales Cary Cohen, who focuses on the disposition of properties throughout South Florida; and Hunt Mortgage Group SVP Marc Suarez, who was tapped by Hunt recently to expand its commercial mortgage financing business in Miami. The panelists acknowledged that Miami's always been a condo town, and because of the continuing influx of flight capital, that isn't likely to change. Since the tide of investment tends to focus on luxury properties, the city is facing a shortage of residential properties that appeal to middle- and upper-middle earners. Even the highest paying jobs come with support staff, and they need a place to live.  Arnstein & Lehr attorney at law Rebecca Abrams Sarelson, who moderated; ADD principal Jonathan Cardello, whose firm is designing the redevelopment of the old INS HQ on Biscayne Boulevard; and Plaza Construction Group FL president Brad Meltzer, AIA Miami's most recent Contractor of the Year. Non-traditional companies—tech, for instance—are now considering Miami more seriously as a location than they ever have, the panelists explained, and some of them are coming here. But tech companies have some difficulty finding talent here, despite the tax benefits compared with a place like Boston or San Francisco. There also need to be more large corporate HQs here (tech or otherwise) before there's a major influx of the smaller companies and startups that feed off of them.  Franklin Street regional managing partner Greg Matus, who also moderated; Aria Development principal David Arditi, who's developing 321 Ocean in Miami Beach; and Berkowitz Development Group president Jeff Berkowitz, who's developing Skyrise Miami. The overseas investment that's been driving so much of the market has graduated from putting flight capital into condos into seeking commercial deals, the panelists observed. Core housing is still the darling among foreign investors, but they're also going to other property types in the region to chase yields. Also, developers in Latin America have family members opening operations here and are partnering with local owner-operators. In short, foreign capital is becoming more actively involved in Miami.  Sakor Development principal Barbara Salk, who's developing ION East Edgewater; Metro 1 Properties CEO Tony Cho, who's helping remake Wynwood and other urban neighborhoods; and Miami Worldcenter Associates managing principal Nitin Motwani, who's overseeing the creation of 1M SF in experiential retail and other uses just north of the CBD. In the retail market, Miami's having a special moment, the retail experts say. A lot of attention's been paid to the retailing successes in Design District, but retailers are doing very well in most markets, including longstanding hubs such as Bal Harbour. The main reason retail will continue to do well: Miami's still under-retailed. |

|

|

Lucky Event Goers Take Home Something Extra |

||

When you say "Show me the money," Bisnow's Brian Kinslow takes you seriously. We had a drawing for a $2,500 cash prize at the event, sponsored by Crocker Partners and Cushman & Wakefield, and three winners took home the dough. Congrats, TWSA Florida Real Estate's Glen Mowatt, Allen Morris Co's Bill Cutler, and Kimley Horn's Christopher Flace. |

We also stopped by to see Arthur Trapp from Baker Audio-Visual, who handled all things audio-visual at our event. Baker was the first audio visual integrator in the Southeast and one of the first in the country, and today provides large-scale corporate AV services. Finally, kudos to Boardroom Communication's Todd Templin for taking pictures of our event. |

|

|

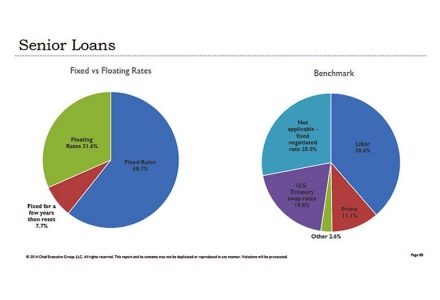

Capital Stack Report!When it comes to senior lending terms, prepare yourself for a surprisingly wide gap in points and fees. This according to the Capital Stack Report conducted by Bisnow and Chief Executive Group. For Libor-based loans, the study finds that there is a 135 basis point difference between the 25th and the 75th percentile, and a 325 basis point difference between the 10th percentile and the 90th percentile. While half of the buyers studied pay over 1% in bank fees, 49.4% pay less than 1% in fees, and 15.4% pay under 0.5% in fees. As well, 49% of borrowers are required to provide a personal guarantee, while the majority (51%) do not. As far as termination fees, 39% pay but 61% do not. What does that mean for you? Let the borrower beware. Be an informed bank customer so that you can assure yourself the most competitive bids. To purchase your copy of this game-changing industry study that will help you master your financing, click here. |

|