|

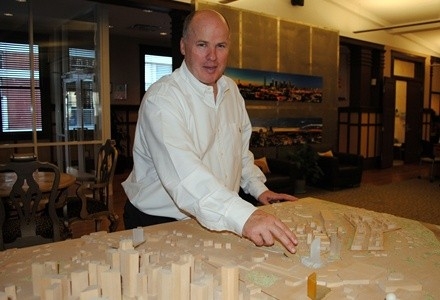

We like catching up with Canadians who are also doing big things south of the border. And it doesn't get bigger than Big D. Jack Matthews, who grew up in London, Ont., has been busy making his mark in the Dallas area (with the temperature differences, who could blame him?).  Jack is building a reputation as a formidable developer, in particular breathing new life into South Side on Lamar and revitalizing Big D's convention industry with the development of the Omni Dallas. He also just completed the 2M SF Bow office tower in Calgary, with residential and commercial development work in Vancouver on his to-do list (as well as the completion of a 600k SF warehouse in Toronto).  The Canadian set up shop in Texas in '87, bringing his wife (dancing with him here) and four kids in '94 (the kids are now adults and scattered across the US). From the age of 5, he was traveling with his dad to construction sites and learning the business. After grad school, he went to work in the family business and ultimately ventured into development (which, he says, was a better fit for him than construction). He's adopted a new hobby in the past year: road biking. A normal weekend can include 17- or 24-mile rides  He spends half his time in Dallas, the other half in Canada. The head of Matthews Southwest (showing us his Big D model in his office; Lego has a future in selling kids on city planning) is in the beginning stages of a 200- to 300-unit apartment deal in the Dallas South Side project, which should start this spring. He's already got the South Side on Lamar apartments, the 164-unit Bellevue building with a targeted July 31 opening. He started stockpiling the South Side land in '88 and owns 112 acres today.  Jack (here at the Omni Convention Center hotel opening in 2011) admits to being a risk-taker, but considers himself an intelligent gambler who went against the common wisdom and ventured south of I-30. The land was priced low (and some still is), and when he had an appraisal done, one parcel was purchased at $8/SF. Just 300 yards away, the land was $30/SF. (What magic happened in those 300 yards? Well, you wouldn't believe us if we told you.)  One universal component of Jack's projects: they're mixed-use and typically include a hotel or residential component. (Above is The Bow in Calgary.) The key, he says, is to let the market dictate what goes into the spaces. He's not a one-size-fits-all developer. His latest project in development is on the northwest corner of Hwy 380 and the North Dallas Tollway. The first phase will feature a mixture of retail, office, and residential, essentially creating an urban place. |

|

|

FRHI's Big Plans |

||

Toronto-based FRHI Hotels and Resorts is branching out in a big way in 2014, expecting to open seven new properties worldwide across its three leading hotel brands, the company has announced. (Another positive: Its frequent flyer miles are about to go through the roof.) FRHI prez and COO Michael Glennie says it's targeting 50% growth over the next five years around the Raffles Hotels & Resorts, Fairmont Hotels & Resorts, and Swissotel Hotels & Resorts brands. Swissotel Sochi Krasnaya Polyana and Swissotel Sochi Kamelia are opening in time for the upcoming Winter Olympics; a new Fairmont Riyadh is opening in Saudi Arabia; and a new Raffles Istanbul is opening in Turkey, to name a few. (The hotel execs must've bought a lot of Rosetta Stone software recently.) In total, FRHI will be adding 1,300 guestrooms this year. |

What's driving the development? Michael tells us it comes down to several key factors—the opportunity to round out FRHI brands in gateway cities and top resort locales where they currently don't have a presence, strategic development partners who have come to FRHI for their expertise in hotel and resort management. Also, developers looking to FRHI because of their experience managing multiple segments—business, leisure, MICE, residential, and emerging new markets where economic growth is taking place. |

|

|

The Nordstrom FactorOne advantage Nordstrom has over Target in terms of expansion in the Canadian marketplace, in particular the GTA, according to DIG360 founder and retail consultant David Ian Gray: “They are not as aggressive in the number and speed of store openings as Target was. So they should not have logistics issues,” he says. Nordstrom announced last week they were moving into the Eaton Centre in 2016. There also will be stores in Yorkdale Shopping Centre (2016) and Sherway Gardens (image, 2017). Overall, there are more critical eyes on all of the significant US retail openings in Canada, in large part because of the news attention they have been generating, David adds. |

|

|

Analysts: Allied Set For Strong Growth |

||

A solid balance sheet for Allied Properties REIT (AP.UN, $32.46) will give it the flexibility to take on more growth opportunities that come its way in 2014, Dundee's Frederic Blondeau tells us. “It was set to be a quiet year for them in terms of external growth as the REIT was focusing on internal growth initiatives,” he says. “But they are seeing more opportunities than anticipated and they could potentially surpass last year's $200M in acquisitions.” |

In the image is Allied's Peter Street development. Allied the other day announced the acquisition of two properties in Calgary and one in Montreal ($69.2M), as well as their existing JV with RioCan, acquiring a parcel of land at Palmerston and College with a 10k GLA heritage building ($7.7M), which will be intensified into a mixed-use development. Dundee sets the 12-month target price for Allied at $36.50. |

|

|