San Francisco Chart of the Week: Where is the Silicon Valley Market Heading?

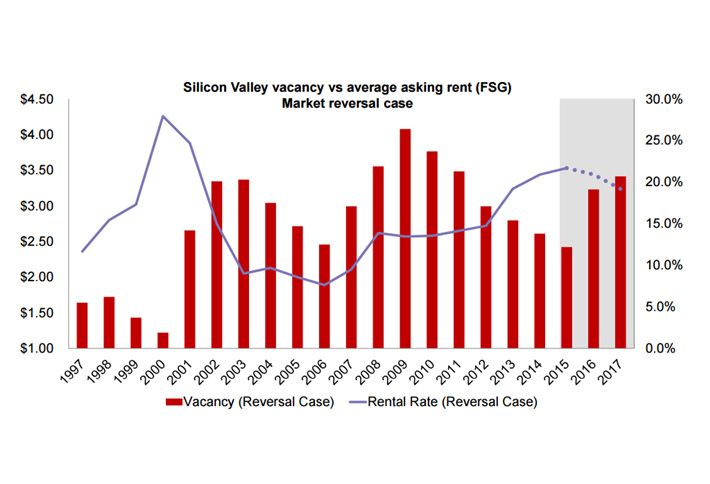

In a new chart from JLL Research, the firm imagines what would happen in the case of a market reversal, when employment growth would fail to maintain its current growth rates.

The firm believes that the high cost of living and lack of housing in the Bay Area would cause markets to migrate, while venture capital firms would be reluctant to fund due to "lackluster IPO performance and poor returns."

As tech companies and startups fled the pre-leased new-construction spaces they were ambitiously banking on, there would also be a large amount of sublease space hitting the market, leading to an average rental rate of $3.24/SF, as opposed to the current rate of $3.53/SF. In addition, the overall vacancy rate would jump from 11.2% to 20.7%.

This very dire scenario, however, would only occur if overall market conditions and local infrastructure were to fall apart.