Real Estate's Best Kept Secret?

Seniors housing has yielded huge returns for savvy investors who bought in over flashier office, retail, and multifamily deals. But according to one local pro, the secret may be out. (Probably because seniors don't like when you whisper.)

Capitol Seniors Housing's Scott Stewart (top row middle, snapped this morning) tells us that while the future remains bright for the sector, hungry investors are arriving on the scene: "Institutional groups used to stay away because they didn't understand it, but a flood of capital has come in the past three or four years." The DC region is "at the top of the heap" of seniors housing markets institutional investors are looking at, thanks to high barriers to entry (due to few new construction starts) and a huge population that creates big demand. With Scott are colleagues (bottom row) Scott Hillman, Hanneke Talbot, Scott Moorhead and (top) Kyle Henderson, Paul Weir, Fred Moon, and Janice Kruger.

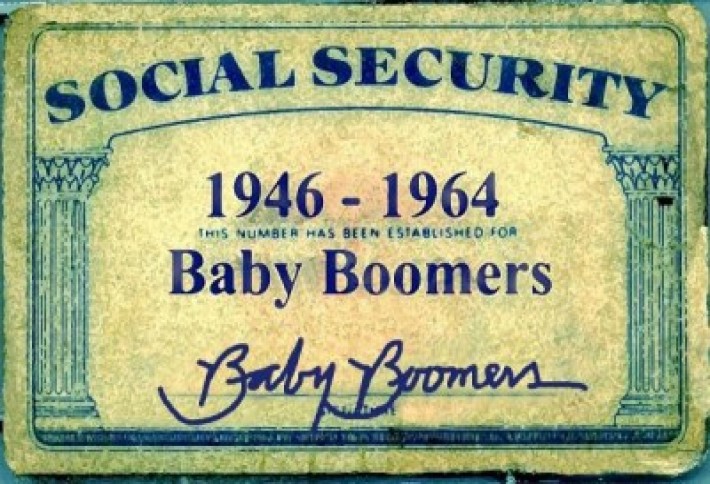

Scott tells us what ultimately drives demand for seniors housing, in DC and nationally, is demographics. He cites a US Census figure that 10,000 Baby Boomers will turn 65 every day for the next 18 years.(The Olive Garden will live to regret its AARP discount.)Plus, many future residents are turning a corner in terms of accepting the lifestyle--the acceptance ratio of the product has doubled in the last decade but remains in the single digits, he says. "And it's a product that's constantly being reinvented," Scott points out, as operators add more amenities and activities.

Here's Arbor Terrace of Tucker, one of the CSH's properties outside Atlanta. (Like a senior citizen with his socks, it's not concerned about matching colors.) This year, CSH--which counts the Harvard endowment as an investment partner--is chasing both stabilized properties and new development, Scott tells us, with a few opportunities under contract. He says the lack of new construction in the industry is "counter intuitive" since demand from renters remains so high.