April 9, 2019

April 1, 2019

Much Was Planned, But Little Is Built As Final Piece Of Metro's Silver Line Approaches Its Debut

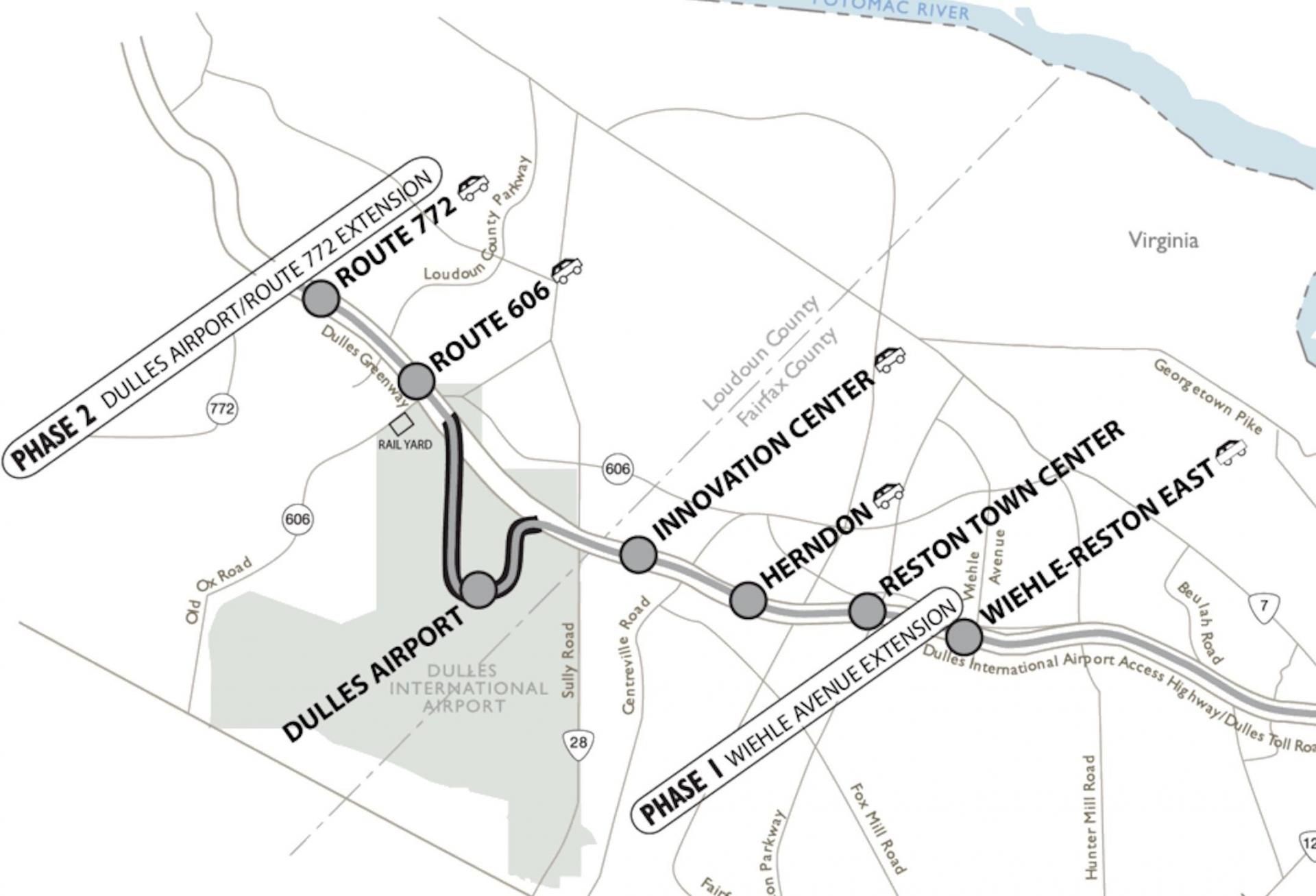

The second phase of the Silver Line is slated to open next year, completing the long-planned, 23-mile addition to D.C.’s Metro system that will bring riders through Fairfax County and into Loudoun County. What awaits riders when they get there will be less than what many who backed the project had hoped for.

The overarching goal of the project, led by the Metropolitan Washington Airports Authority, has been to connect the regional transit system to Dulles International Airport. But the line will extend past the airport with two additional stops in Loudoun.

The county committed to invest over $270M in building the final portion of the Silver Line to improve transit options and spur commercial development. While rising property values and data centers have allowed the county to achieve enough revenue to pay off the investment, the type of mixed-use development it envisioned around the stations has thus far been slow to move forward.

With the rail line beginning service next year, any development that will be completed on opening day would likely already be under construction, offering a glimpse of what riders will see around the Metro stops on day one.

The penultimate stop on the line, dubbed Loudoun Gateway, is unable to support new housing because of its proximity to the airport, and the land around it is being bought up by data center developers. The Ashburn station at the end of the line has several developments planned around it, but just one developer has broken ground thus far.

“There’s a big investment that’s been made by Loudoun County in the Metro system. There’s not a lot of development going on around at the end of the line,” said Chris Clemente, the one developer who has moved forward with a project near the Ashburn stop.

Developers and city officials expect it will take years before enough office demand exists to support the construction of all the commercial space planned around the stations. Multiple developers with 100-plus acre sites are beginning with the residential components to create activity that could help attract companies.

But the relative lack of completed development around the stations could present challenges for the line’s initial ridership performance, with the Metro system already experiencing decreasing usage across the region.

Even if commercial development and ridership takes years to fully materialize, the county remains confident in the investment it made, given what it has seen so far.

Speculation around the future impact of Metro has led property values around the under-construction stations to more than double, and while data centers don’t create the vibrancy planners have envisioned, they do help fill the county coffers.

Transit-Oriented Data Centers

Loudoun County has become the nation’s leading hub for data centers in recent years, with builders of the facilities scooping up hundreds of acres in the Ashburn area. Data centers don’t need to be near transit stations as much as other forms of development, since their value is derived from the underground fiber network.

Nevertheless, the area around one of Loudoun’s two new Metro stations appears destined to be dominated by buildings that host the cloud, not residents or shoppers.

Because of its proximity to Dulles, the area around the Loudoun Gateway station at Route 606 is subject to airport noise contour regulations, which prohibit residential development, but allow for commercial buildings. But today’s office and retail tenants gravitate to mixed-use environments with housing, even in the suburbs, making commercial development more difficult.

Large plots of land once envisioned as dense, urban developments have been bought up by data center developers. Loudoun County Supervisor Ron Meyer, who was elected after the county passed the $276M agreement to extend Metro, said he thinks it was a bad deal.

“The biggest issue is the location of the 606 Metro station; Loudoun Gateway was put in a place that makes no sense,” Meyer said. “You can’t put mixed-use development there, it’s going to be data centers because that’s who bought the land. So that was probably the biggest mistake in the deal.”

A 280-acre piece of land near the Loudoun Gateway station, once envisioned as a 14M SF mixed-use development, last year sold to Sentinel Data Centers. H. Chris Antigone, who once planned to build a convention center, hotels, office and retail on the site, dubbed “International City,” said the pivot to data center use is bad for the county.

“It won’t be vibrant. It won’t be anything like what we envisioned,” Antigone said. “This is a tragedy for Loudoun County.”

Loudoun County Economic Development Director Buddy Rizer acknowledged that the Loudoun Gateway area is more likely to be built up with data centers than mixed-use development, but he pushed back against the notion that it represents a negative for the county.

Data centers provide tax revenue that help the county pay for the Metro, he said, and the station will have parking garages for commuters and connecting bus lines that will improve the area’s connectivity.

“I don’t look at it by one station, I think it’s all of the stations combined and how they fit into the overall transportation network,” Rizer said. “I think [Loudoun Gateway] is going to be a station that is going to provide a lot of opportunity for our residents to access Metro.”

Development Begins At The End Of The Silver Line

With the Loudoun Gateway station destined for data centers, planners are pinning their hopes for urban-style, mixed-use development on the Silver Line’s final stop in Ashburn.

Several large-scale projects are planned around the Ashburn station that could bring thousands of housing units and millions of square feet of commercial space. But just one project has been developed in time for the Metro’s 2020 opening, and it could be years before the market provides the demand necessary to build all of the planned office space.

Comstock Partners has completed the first phase of its Loudoun Station development, featuring a movie theater, apartments, retail and 50K SF of office space, all of which has been leased. The developer is now building the second phase, slated to include additional residential and retail space. It has a 175K SF office tower in the planning stages and Comstock is still determining whether to break ground speculatively or wait for pre-leasing.

“It’s still a year or so away before the train starts operating, so we’re still watching the market to see when the right time to pull the trigger is,” said Clemente, the CEO of Comstock Partners. “The good news for us out there, as far as development around the station, there’s nobody building anything besides Comstock.”

Comstock is also building the Reston Station development at the Wiehle-Reston East station, the terminus of the Silver Line’s first phase, giving it a preview of how development and office demand could unfold in Ashburn. Comstock has broken ground speculatively on three office buildings at Reston Station, each beginning after the Metro station’s 2014 opening.

The first Reston Station office tower delivered in 2017 at 1900 Reston Metro Plaza and just recently picked up leasing momentum with a 100K SF lease with Google. Clemente said it has seen a major boost in interest in office space, giving it the confidence to break ground on the second and third buildings on spec. But Reston has far outpaced Ashburn office leasing even before Comstock’s new towers.

“I think Reston is probably 10 years ahead of Ashburn in terms of being a hub for commercial development,” Clemente said. “It was a couple years after the rail was operational before we saw an increase in interest in office space [in Reston]. It’s hard to tell when that will start in Loudoun.”

Waiting For Office Demand's Return

Multiple other large-scale developments planned around the Ashburn station that have yet to begin construction are also largely dependent on office demand to realize their full potential.

The Gramercy District, a planned 2.5M SF “smart city” next to the Ashburn station, has been planned for at least three years, but little activity has taken place on the 17-acre site. Developer Citylink.ai’s website says it will deliver a 300-unit apartment complex and a 350K SF office tower in 2021. Citylink CEO Minh Le did not respond to multiple requests for comment.

Comstock previously controlled the land for Gramercy District, which is adjacent to its Loudoun Station project. Clemente said some work on the street grid has taken place on Citylink’s site, but the developer is still going through the site plan process before constructing any new buildings.

On the other side of the Ashburn Metro station, a 210-acre site has welcomed hundreds of new residential units, but no commercial development activity. The site, owned by the Claude Moore Charitable Foundation, is approved for over 9M SF of nonresidential space, plus 6,000 housing units.

The foundation is selling off the site in individual pieces to developers. It began by selling the land on the western edge of the site, farthest from the Metro, to developers of single-family housing and townhouses.

It is now seeking developers to buy the parcels within a half-mile of the station, where the highest-density commercial development is planned, but it has yet to reach any deals.

“The foundation was hoping to keep land that would become more valuable as Metro opens up,” said Randy Sutliffe, the Claude Moore Charitable Foundation's deputy executive director. “The business plan was to sell stuff farthest away from the station whose value was less dependent on Metro.”

The foundation is being patient to make sure the developments on the Metro-adjacent parcels are accretive to the rest of the site. Sutliffe and Guy Gravett, a real estate broker working with the foundation, both said they do not want to see data centers built on the site.

“We don’t want to go out here and sell for the highest price for a data center,” Gravett said. “We’d rather find uses that bring employment and bring people to the site, which will add value to the remainder. What is a city without people?”

A 158-acre property in between the Ashburn and Loudoun Gateway Metro stations was approved March 21 for 3,700 residential units, 740K SF of office and 240K SF of retail. The developer behind the Silver District West project, Soave Enterprises, plans to begin by building townhouses, said Cooley’s Colleen Gillis, the project’s land-use attorney. It then plans to build multifamily with ground-floor retail.

“Part of the reason we’re starting with townhomes … we hope to bring rooftops there, so when we build multifamily buildings with ground-floor retail, we already have an established base of people who will utilize a restaurant or a gym,” Gillis said.

The developer does not have a timeline set for building the office component and hopes to sign pre-leases before breaking ground, Gillis said. But the project’s agreement states it must build 125K SF of office by the time it delivers 1,500 residential units, and 250K SF of office before it completes 2,500 units.

“The reality is right now, we could do office in a non-mixed-use way, but there’s no demand for it,” Gillis said.

Loudoun County Chamber of Commerce President Tony Howard said he understands why developers are hesitant to break ground on spec office projects in Ashburn.

“It’s not that surprising you’re not seeing a whole lot of commercial development,” Howard said. “I think until you have Metro stood up, it’s going to be difficult to get investments necessary to build office buildings.”

Howard said it will take time for the Silver Line to translate to office demand and spur the construction of new commercial development.

“We have to be realistic and expect that Metro is not changing things overnight,” Howard said. “It’s not turning us into the Rosslyn-Ballston Corridor in three years.”

The Cloud Hanging Over Metro

The relative lack of large-scale development around the final two stations could make meeting ridership projections a challenge.

Metro faces declining ridership across the system, reaching an 18-year low in the second half of 2018, and the first phase of the Silver Line experienced a disappointing rollout.

Ridership on the four Tysons stations fell below projections in the first three years after its 2014 opening, but it has since rebounded. In the final three months of 2018, ridership at the Silver Line Phase 1 stations was up 5.6% from the same period the year before, according to the Northern Virginia Transportation Commission.

Clemente said delays and service cuts during Metro’s recent maintenance programs hurt the ridership numbers at the Wiehle-Reston East station, but he expects it to bounce back.

“We have definitely seen a drop-off in ridership at the Reston station while that work is going on and while system upgrades are being done,” Clemente said. “But I’m pretty confident that when work is completed, which is supposed to be next year, they’re going to meet their ridership projections.”

Planners have decreased projections for ridership on the Loudoun County stations of Silver Line Phase 2 since the initial studies of the line were released, according to the Northern Virginia Transportation Commission.

The latest projection from the Metropolitan Washington Council of Government’s Transportation Planning Board expects average weekday ridership at the Ashburn and Loudoun Gateway stations will reach 6,900 by 2025, with 88% of that at the Ashburn station. The Silver Line’s 2004 Environmental Impact Statement projected 11,400 riders between the two stations with 60% at Ashburn.

Low ridership totals at the individual Loudoun stations wouldn't hurt the county's bottom line, Meyer said, adding that the only way Metro ridership could impact the county’s budget is if system-wide shortfalls lead WMATA to ask localities to pay more for annual operations.

Loudoun’s Return On Investment

Even without an overnight commercial development boom, rising property values and data center revenues give Loudoun County officials confidence that the investment it made in the Metro extension will pay off.

Along with the $276M the county committed for construction costs, it will also contribute to Metro’s annual operating budget, with an initial payment expected to be $17M this year. To fund the investment, Loudoun created special tax districts that include only the land around the Metro stations.

The county began collecting revenue from the special tax districts in 2014, and its annual collections have already exceeded projections before Metro’s opening, Rizer and Meyer said.

Property values in the special tax districts increased by 110% between 2013 and 2018, compared to a 46% county-wide increase, according to the February Metrorail Financial Update from the Loudoun County Finance/Government Operations and Economic Development Committee. The report said half of that value appreciation has occurred over the last year, during which time property values have surpassed the projections made in 2014 when it secured a loan from the Department of Transportation.

“Data center revenue is what’s keeping the tax districts healthy,” Meyer said. “The biggest concern we had was, are we going to have revenue to make Metro payments? What we’re seeing is revenue projections are way over what we forecast. We’re in great shape for those.”

While riders arriving to the stations on the first day of service next year may see large plots of undeveloped land, county officials emphasize the Silver Line was always a long-term investment, and it will take years before its impact will be fully realized.

“Overall, things are looking really positive for the future of these Metro stations in the county," Meyer said. "We can't fix the past. All we can do is maximize the future."